According to the National Pawnbrokers Association, there are approximately 11,000 pawn stores in the United States. Most of these shops are family-owned small businesses. The pawnshops employ about 35,000 individuals and contribute $3 billion to the US economy.

Pawn shops are highly regulated. There are federal and state regulations and laws that pawn shop owners must comply with, and owners work with local law enforcement to deter theft and the possibility of selling or pawning a stolen item.

Characteristics of Pawn Customers

Today, pawn customers are working families in America. Shoppers may include people wanting to invest in gold, silver, and precious metals, or people looking for a luxury item to add to their possessions.

People borrowing money may unexpectedly need a short-term loan, and are either under banked or don’t have a bank account. Pawn transactions keep bills paid, the rent paid, or provide funds for an unexpected emergency. Pawn shops provide an alternative financial safety net to over 30 million Americans.

Types of Items

Pawn shops specialize in different types of items. they take gold, silver, precious metals, name brand tools and electronics, cars, motorcycles, guns, fine jewelry, diamonds, collectibles, luxury watches, designer purses and any valuable they will make money on if they have to sell the items because a borrower defaults on the terms of their loan.

Pawn Shop Profit Margin

There is no standard profit margin for pawn shops, and different shops have different profit margins. Earning interest on loans and profits on retail sales are the principal income sources for a pawn shop’s standard business model.

Pawn shops aim to generate net profit margins of at least 15% to 25%. The amount of money a pawn shop owner makes varies by region. The average salary is just over $32,000 a year. Many pawn shops have sideline business to increase their annual income.

A pawn shops profits depend on many factors. The length of time a shop has been in business affects customer flow and returning customers. The pawn shop size, including rent/lease fees, personnel costs, and utilities, impacts profits. How well the pawn shop markets to bring in new customers and nurture existing customers affects profit.

Each pawn shop owner will tell you that the state of the economy affects pawn shops. When the economy is good, pawn shops write fewer loans, but have more retail products. When the economy is in recession, pawn shops lend more money, and default on collateral loans (pawn loans) increase.

Starting a Pawn Shop

You don’t have to have a degree to start a pawn shop. There are no educational requirements to own, operate, or work at a pawn shop. A business degree might make a pawn shop owner more successful. According to Zippia, about 47% of pawnbrokers have a high school diploma, while another 21% have an associates degree .

Owning a pawn shop requires certain skills and experiences. Finance and math skills, understanding banking, finances, interest payments, business structure, and how financial institutions operate, will make operations smoother.

Today, the average pawn customer does not have access to traditional banking lines of credit, nor will traditional banking provide such small loans. Short term loans with no credit checks provide borrowers with money they can’t get through other means. Nationwide, pawnbrokers make thousands of loans daily for less than $50.00. Pawn customers need short-term loans and non-recourse access to cash that isn’t based on their credit scores, background check, or income level.

Collateral loans are based on the value of the personal property owned by the borrower and presented as security to the pawnbroker. Sports equipment, musical instruments, precious metals, gold, silver, designer handbags, a diamond ring, luxury watches, and other valuable items can be used to secure a collateral loan.

Nationwide pawn transactions average less than $180. Pawn consumers borrow against personal assets in a manner similar to others borrowing against real estate, stock or insurance policies.

Interest Rates

Pawn shops charge interest rates on the short-term loans they write. Interest rates and finance charges for pawn shop loans can be high. They can be between 5% and 25% a month. The design of a pawn loan is a short-term loan so that interest rates don’t add up. To fund loans, pawnbrokers have a business bank account or investors who provide financial resources, making large pawn loans (depending on the collateral) available.

The Consumer Financial Protection Bureau states in a 2017 report that pawns do not harm consumers, are not confusing, and do not put consumers in a cycle of debt.

Start Up Costs and Steps For a New Pawn Shop

Owning and operating a business takes more time and effort than just filing a business name with the Secretary of State. There are few things to think about and do before you jump in as one of America’s small business owners.

Plan your Pawn Shop: A new business owner must have a clear plan if they are successful. Mapping out the details of your business and what the unknowns might be will help you before you take the leap.

Who is the target customer for the shop? Since a pawn shop makes money in multiple ways, it needs to attract more than one type of customers to be successful. Pawn shops write short term loans. They make money on the interest charged on the funds lent. Pawn shop needs customers who want to save money buying preowned items.

Form your Pawn Shop into a Legal Entity: The most common business structure types are the sole proprietorship, partnership, limited liability company (LLC) and Corporation. Each type is established to protect you from being held personally liable if your business was sued.

Register your Pawn Shop for Taxes: Different business structures have different tax liabilities. Registering to pay taxes requires getting an EIN from the IRS. You will need to register for various state and federal taxes before you can open for business.

Open a Business Bank Account: Applying for a business bank account separates the business finances from your personal finances. Using dedicated business banking and credit accounts is necessary to for asset protection. If you mix personal and business finances, you could be at risk if your business was sued.

Set up Accounting for your Pawn Shop: Recording your expenses and income electronically or through paper and pencil is up to you. Recording this information somewhere is essential to understand the financial performance of your business. When you have to file taxes, you will be happy you did.

Get the Necessary Permits & Licenses for your Pawn Shop: Pawn shops have different rules and regulations they must follow. These laws are different in different states. Certain tax laws may apply, as well as regulations regarding financial institutions.

Get Pawn Shop Insurance: Just as with licenses and permits, your business needs insurance to operate safely and legally. Business insurance protects your company’s financial wellbeing if you have a covered loss. A General Liability Insurance policy is a common coverage for small businesses. A knowledgeable insurance agent will help you determine what options are for your small business.

Create your Pawn Shop Website: In today’s global network, having a website is essential. Most pawn shops have one, and people are accustomed to searching online for what they need and want. Common startup costs include having a website built that represents your shop. The website will help bring in customers and serve as a backdrop for social media accounts that will advertise your business.

Your website can also include an online store for online sales as part of your marketing approach.

Set up your Business Phone System: Getting a phone set up for your business is one necessary if you are going to separate work from home. It also helps you make your business more automated and gives your small business legitimacy.

Customers want to connect to your business products and services. Having a phone systems promotes this.

Design a Marketing Plan: In today’s world, small businesses have to have marketing strategies if they are going to stay ahead of their competition. As a new pawn shop owner, you will be one of many new pawn shop owners who runs out of time. Whether you are taking in loan collateral, stocking shelves, interviewing to hire employees, setting up bank accounts, or any other multitude of tasks, pawn shop owners don’t have time to answer every phone call or follow up on every lead.

Consider working with Pawn Leads, LLC to help with saving time. They are experts in helping pawn shops today, so they are successful tomorrow.

Pawn Leads

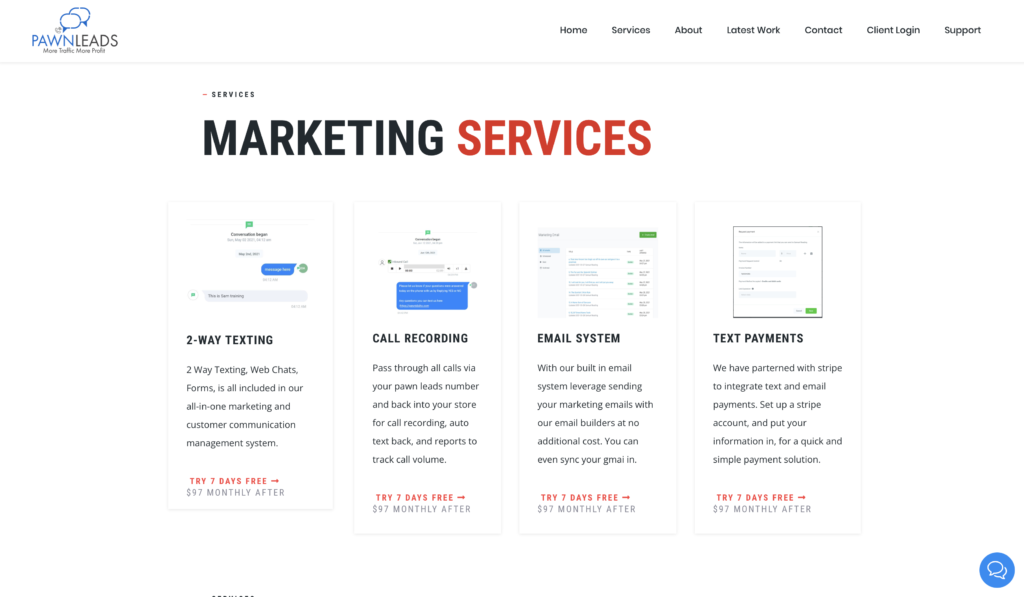

Pawn Leads, LLC is a full-service integrated marketing solution.

Pawn Leads is a Customer Communication System and provides a complete Marketing Solution for Pawn Brokers and small businesses.

All communications from your customers are tracked in one convenient place: custom automated follow-up text, email, and webchat replies. Make connecting with your avatar easy. Get phone call feedback to help close more deals. The service provides text blasts, email campaigns, SEO, Google and FB ads, blog posts, press releases, and more tailored to your company.

As one of the new pawnshop owners, don’t hesitate to contact us for help. The owner of the company is a pawn shop owner and understands how pawn shops make it or don’t. He and his expert team plan to help one pawn shop at a time until everyone is successful.